individual supply commercial property gst malaysia

Looking to expand your knowledge on a particular subject matter. Requiring help with paraphrasing your.

Under the 18th amendment to the Constitution of Pakistan the right to charge sales tax on services has been given to the provincial governments where as the right to charge sales tax on goods has been given to the federal government.

. Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is bought on or after 28102000 has been increased from RM50000 to RM100000 on condition. Residential property prices in South India hike by 810 due to rising input costs and disruptions in global supply. This agreement means the agreement that incorporates these general conditions.

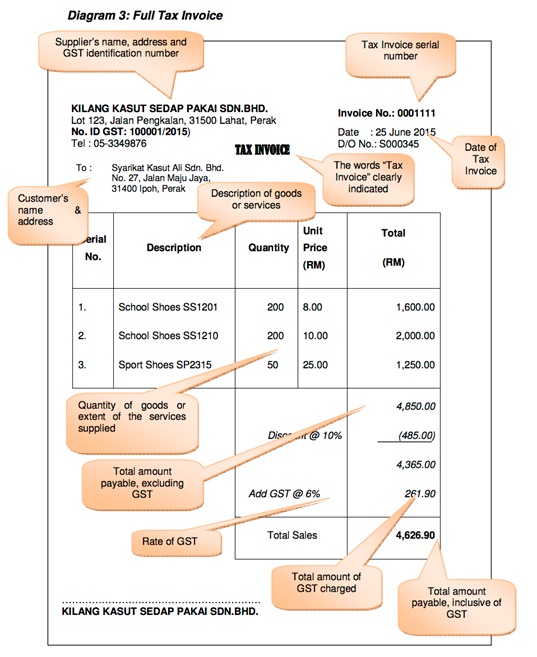

Singapores economy has been previously ranked as the most open in the world the joint 4th-least corrupt and the most pro-business. The supplier can issue a Credit Note when the taxable value or tax charged in the tax invoice exceeds the taxable value or tax payable in respect of such supply. Indirect tax or more commonly knows as sales tax is also applicable on supply of goods and provision of services.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The taxable base is the value of the financial investments at 31 December. An expatriate working in Italy will not be subject to IRAP due to the fact that generally the expatriate is an individual with an employment relationship.

Debit Notes or Credit Notes can be issued only in the following specified situations-. 31 Excess price or tax charged from the recipient. Payments for services in connection with the use of property or installation operation of any plant or machinery purchased from a non-resident.

The prices of critical raw materials including steel cement. Get 247 customer support help when you place a homework help service order with us. Singapore has low tax-rates and the second-highest per-capita GDP in the world in terms of purchasing power parity PPP.

The economy of Singapore is a highly developed free-market economy with dirigisme characteristics. Wishing for a unique insight into a subject matter for your subsequent individual research. Supply Fee means the price charged for Goods ordered by the Customer.

Financial investments owned in Italy by an individual are subject to the Italian wealth tax. We us our means Benara. Buy the best home insurance plans by HDFC ERGO today.

Needing assistance with how to format citations in a paper. Home Insurance or property insurance provides coverage from natural calamities theft fire etc. Situations for issuing Credit and Debit Note.

Taxable supply tax invoice consideration GST and supply have the meanings given to those expressions in the A New Tax System Goods and Goods Tax Act 1999. Industrial or commercial undertaking venture project or scheme. Type of Income Tax Return Form ITRF for Individual Malaysia GST Types of Supply Real Property Gains Tax RPGT 2014.

Taxation And Gst Planning For Investment Property In Malaysia

Buying Commercial Property In Malaysia A Complete Guide

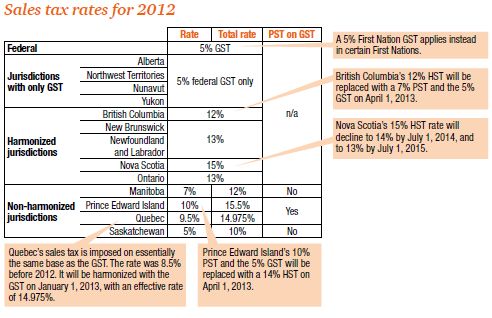

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

Non Resident Businesses Get Ready For Gst Hst Changes Kpmg Canada

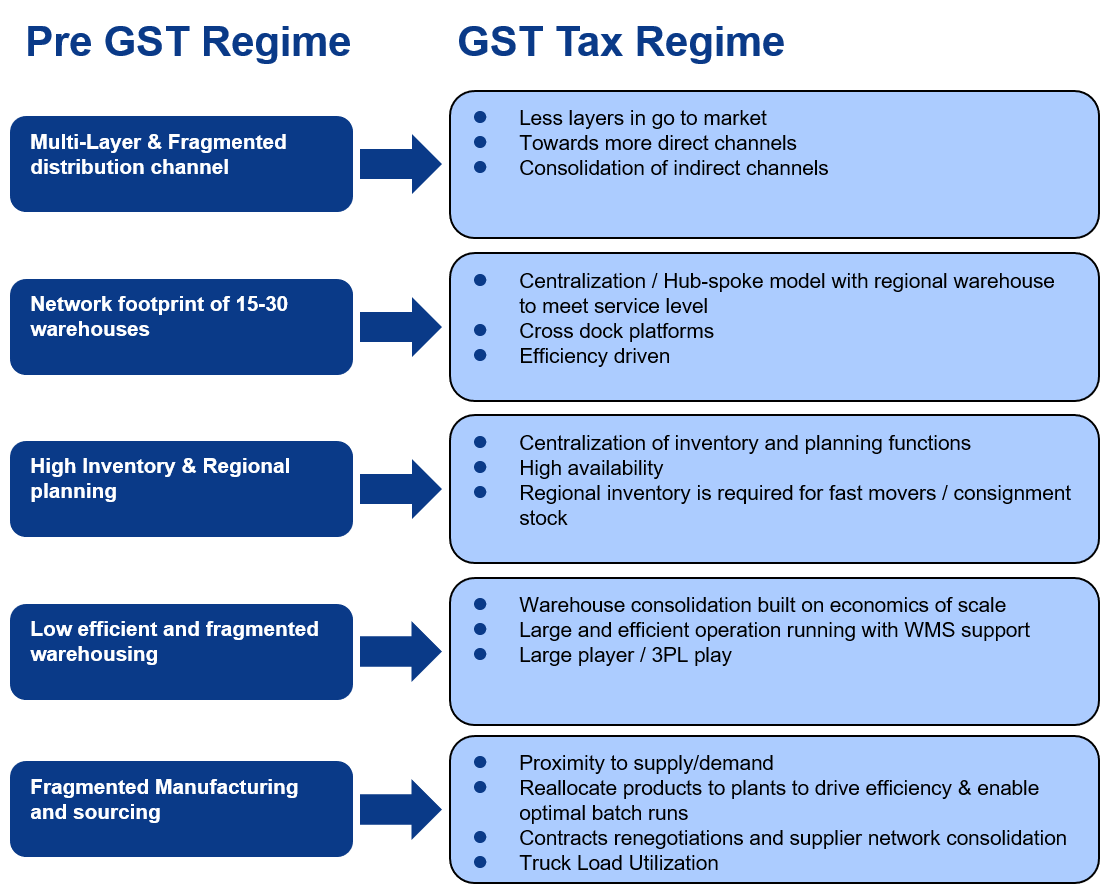

India S Tax Reform Its Impact To Supply Chain

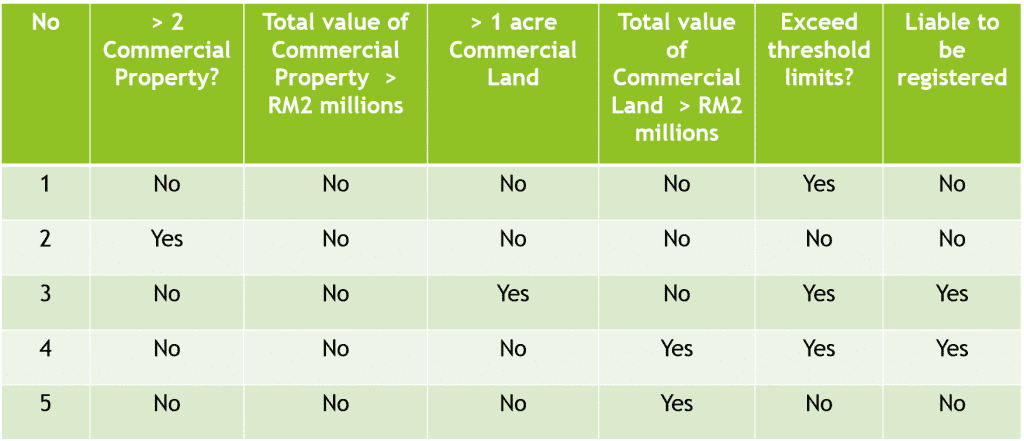

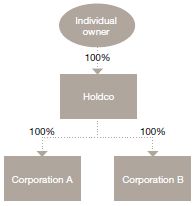

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

Lawyer S Billings How Much Gst Hst To Charge Thang Tax Law

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

Buying Commercial Property In Malaysia A Complete Guide

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

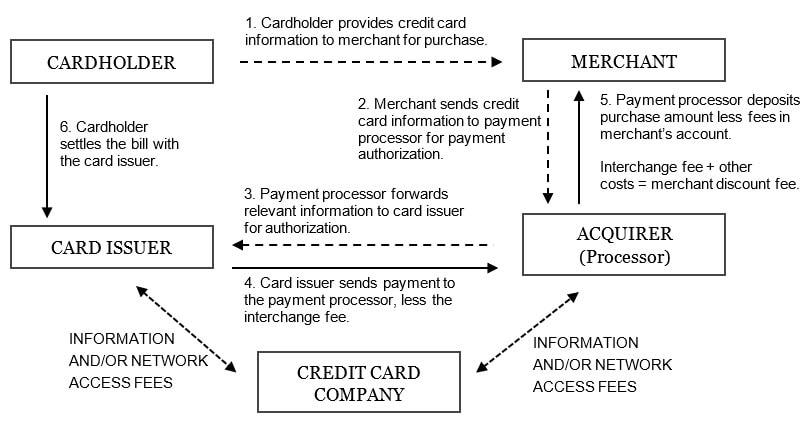

Tax Insights Arranging For The Provision Of Payment Processing Services Is Gst Hst Exempt Pwc Canada

Malaysia Sst Sales And Service Tax A Complete Guide

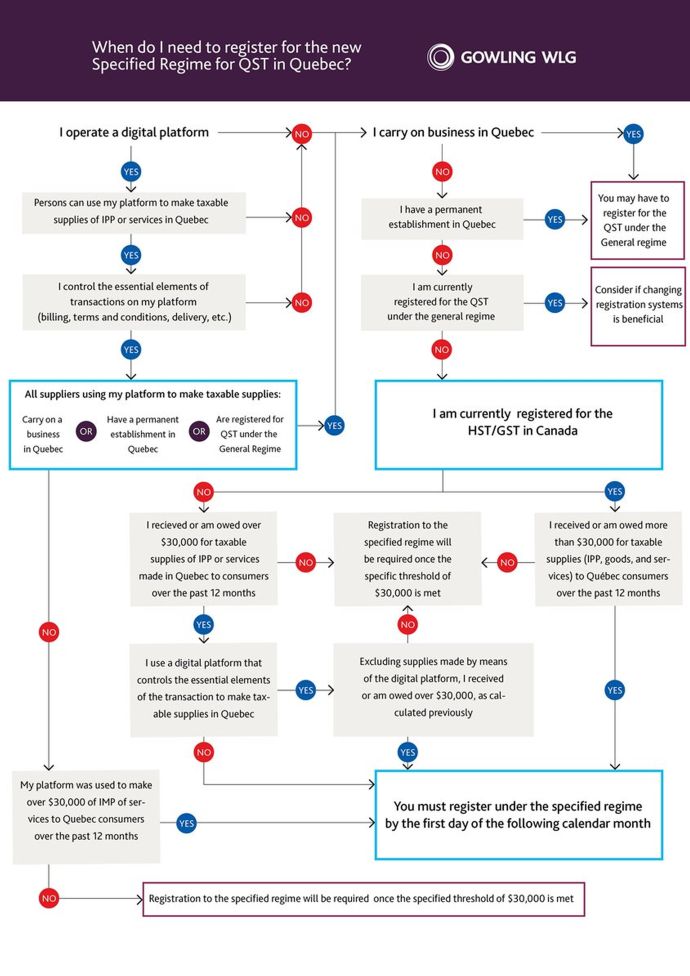

Quebec Moves To Tax Digital Goods And The Virtual Marketplace Tax Authorities Canada

Real Estate New Gst Rates And Challenges

Gst Harmonized Sales Tax Hst Trips And Traps For Privately Owned Businesses Sales Taxes Vat Gst Canada

Pdf Goods And Services Tax Gst Transition To Sales And Services Tax Sst Impact On The Welfare Of B40 And M40 Households In Malaysia

No comments for "individual supply commercial property gst malaysia"

Post a Comment